Is Vehicle Mileage Reimbursement Taxable . — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. the irs sets a standard mileage reimbursement rate of 58.5 cents per business mile driven in 2022. the business mileage rate for 2024 is 67 cents per mile. You may use this rate to reimburse an employee for business use. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. — while it’s not federally required, you should reimburse your employees for the business use of their personal vehicles.

from www.template.net

— while it’s not federally required, you should reimburse your employees for the business use of their personal vehicles. the irs sets a standard mileage reimbursement rate of 58.5 cents per business mile driven in 2022. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. You may use this rate to reimburse an employee for business use. the business mileage rate for 2024 is 67 cents per mile.

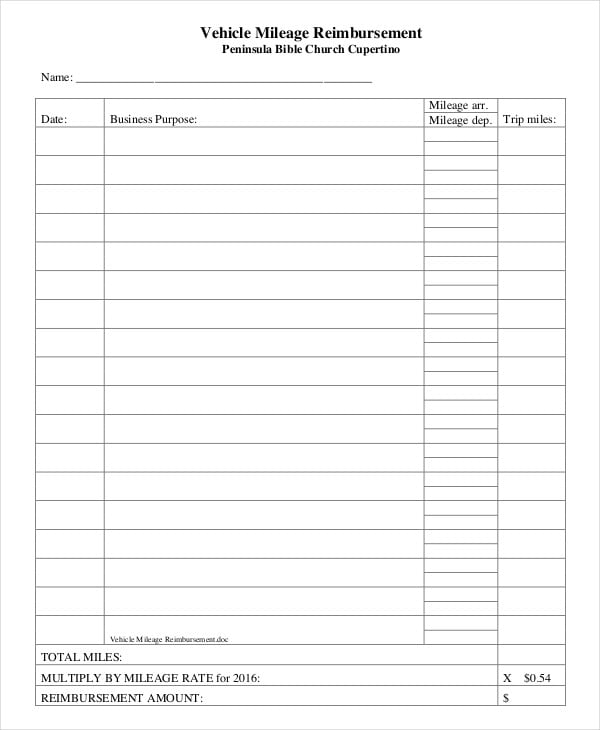

Mileage Reimbursement Form 10+ Free Sample, Example, Format

Is Vehicle Mileage Reimbursement Taxable — while it’s not federally required, you should reimburse your employees for the business use of their personal vehicles. the business mileage rate for 2024 is 67 cents per mile. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. You may use this rate to reimburse an employee for business use. — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. the irs sets a standard mileage reimbursement rate of 58.5 cents per business mile driven in 2022. — while it’s not federally required, you should reimburse your employees for the business use of their personal vehicles.

From www.sampleforms.com

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel Is Vehicle Mileage Reimbursement Taxable You may use this rate to reimburse an employee for business use. — while it’s not federally required, you should reimburse your employees for the business use of their personal vehicles. the business mileage rate for 2024 is 67 cents per mile. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical. Is Vehicle Mileage Reimbursement Taxable.

From www.patriotsoftware.com

Mileage Reimbursement Advantages, Laws, & More Is Vehicle Mileage Reimbursement Taxable the business mileage rate for 2024 is 67 cents per mile. — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. — while it’s not federally required, you should reimburse your employees. Is Vehicle Mileage Reimbursement Taxable.

From www.sampleforms.com

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel Is Vehicle Mileage Reimbursement Taxable the business mileage rate for 2024 is 67 cents per mile. the irs sets a standard mileage reimbursement rate of 58.5 cents per business mile driven in 2022. — while it’s not federally required, you should reimburse your employees for the business use of their personal vehicles. — the irs allows qualified taxpayers to deduct vehicle. Is Vehicle Mileage Reimbursement Taxable.

From www.dexform.com

Mileage Reimbursement Claim Form in Word and Pdf formats Is Vehicle Mileage Reimbursement Taxable You may use this rate to reimburse an employee for business use. the business mileage rate for 2024 is 67 cents per mile. — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. the irs sets a standard mileage reimbursement rate of 58.5 cents per business mile driven in 2022.. Is Vehicle Mileage Reimbursement Taxable.

From www.excelstemplates.com

Mileage Log Reimbursement Form Templates 10+ Free Xlsx, Docs & PDF Is Vehicle Mileage Reimbursement Taxable the irs sets a standard mileage reimbursement rate of 58.5 cents per business mile driven in 2022. — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. You may use this rate to. Is Vehicle Mileage Reimbursement Taxable.

From exceltemplate77.blogspot.com

Mileage Reimbursement Log Excel Templates Is Vehicle Mileage Reimbursement Taxable the business mileage rate for 2024 is 67 cents per mile. — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. You may use this rate to reimburse an employee for business use.. Is Vehicle Mileage Reimbursement Taxable.

From mileiq.com

Car allowances vs. mileage reimbursement MileIQ Is Vehicle Mileage Reimbursement Taxable — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. You may use this rate to reimburse an employee for business use. the business mileage rate for 2024 is 67 cents per mile. — while it’s not federally required, you should reimburse your employees for the business use of their. Is Vehicle Mileage Reimbursement Taxable.

From irs-mileage-rate.com

Mileage Reimbursement For Remote Employees IRS Mileage Rate 2021 Is Vehicle Mileage Reimbursement Taxable — while it’s not federally required, you should reimburse your employees for the business use of their personal vehicles. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. the irs sets a standard mileage reimbursement rate of 58.5 cents per business mile driven in 2022. — washington —. Is Vehicle Mileage Reimbursement Taxable.

From dxovcayuz.blob.core.windows.net

Mileage Reimbursement 2022 California Form at Erna Fabian blog Is Vehicle Mileage Reimbursement Taxable the business mileage rate for 2024 is 67 cents per mile. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. You may use this rate to reimburse an employee for business use. — while it’s not federally required, you should reimburse your employees for the business use of their. Is Vehicle Mileage Reimbursement Taxable.

From www.sampletemplates.com

FREE 8+ Sample Mileage Reimbursement Forms in PDF MS Word Is Vehicle Mileage Reimbursement Taxable — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. You may use this rate to reimburse an employee for business use. — while it’s not federally required, you should reimburse your employees for the business use of their personal vehicles. the business mileage rate for 2024 is 67 cents. Is Vehicle Mileage Reimbursement Taxable.

From www.kliks.io

Mileage Reimbursement Tax Benefits and State Laws Is Vehicle Mileage Reimbursement Taxable the business mileage rate for 2024 is 67 cents per mile. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. the irs sets a standard mileage reimbursement rate of 58.5 cents. Is Vehicle Mileage Reimbursement Taxable.

From www.sampletemplates.com

FREE 11+ Sample Mileage Reimbursement Forms in MS Word PDF Excel Is Vehicle Mileage Reimbursement Taxable — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. — while it’s not federally required, you should reimburse your employees for the business use of their personal vehicles. You may use this rate to reimburse an employee for business use. the business mileage rate for 2024 is 67 cents. Is Vehicle Mileage Reimbursement Taxable.

From www.sampleforms.com

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel Is Vehicle Mileage Reimbursement Taxable the business mileage rate for 2024 is 67 cents per mile. You may use this rate to reimburse an employee for business use. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to.. Is Vehicle Mileage Reimbursement Taxable.

From eforms.com

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word eForms Is Vehicle Mileage Reimbursement Taxable — while it’s not federally required, you should reimburse your employees for the business use of their personal vehicles. — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. You may use this. Is Vehicle Mileage Reimbursement Taxable.

From www.wordexceltemplates.com

Vehicle Mileage Log with Reimbursement Form Word & Excel Templates Is Vehicle Mileage Reimbursement Taxable — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. You may use this rate to reimburse an employee for business use. — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. the irs sets a standard mileage reimbursement rate of 58.5 cents. Is Vehicle Mileage Reimbursement Taxable.

From brandonrutherford.pages.dev

2025 Mileage Reimbursement Rate Irs Brandon Rutherford Is Vehicle Mileage Reimbursement Taxable — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. — the irs allows qualified taxpayers to deduct vehicle mileage related to business, charity, medical or moving. the irs sets a standard mileage reimbursement rate of 58.5 cents per business mile driven in 2022. the business mileage rate for. Is Vehicle Mileage Reimbursement Taxable.

From superkilometerfilter.com

Is Business Mileage Reimbursement Taxable? SKF Is Vehicle Mileage Reimbursement Taxable the irs sets a standard mileage reimbursement rate of 58.5 cents per business mile driven in 2022. the business mileage rate for 2024 is 67 cents per mile. — washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. You may use this rate to reimburse an employee for business use.. Is Vehicle Mileage Reimbursement Taxable.

From www.xltemplates.org

Mileage Log with Reimbursement Form MS Excel Excel Templates Is Vehicle Mileage Reimbursement Taxable — while it’s not federally required, you should reimburse your employees for the business use of their personal vehicles. the business mileage rate for 2024 is 67 cents per mile. the irs sets a standard mileage reimbursement rate of 58.5 cents per business mile driven in 2022. — the irs allows qualified taxpayers to deduct vehicle. Is Vehicle Mileage Reimbursement Taxable.